Time in the market beats timing the market

The recent talk on the street is that we’re entering a bear market. While everyone is consumed with FUD (Fear, Uncertainty and Doubt), this article looks to cut through the noise and propose 4 data-driven reasons why this market is anything but dead.

The simple fact of the matter is that FUD is born out of traders and the media. They push a narrative that fits them. However, the easiest way to block the noise is to think like an investor, not a trader.

Investors have a long-term time frame and don’t get caught up in the overinflated hype that floods our screens on a daily basis.

As Mark Twain so elegantly said, “It ain't what you don't know that gets you into trouble. It's what you know for sure that just ain't so.”

What is meant by this is that believing in a pushed narrative without understanding it can be what gets you into the most trouble when investing. Even though the masses may believe that the crypto market is all but done (what with the bear narrative being pushed all around town), what if the bear market is “what you know for sure that just ain't so”?

Forget the noise, understand the asset.

Crypto is like early-stage tech investing. Throughout history, innovative tech has always brought volatility.

Whether it be the horse to the motorcar (combustion engine), the hand-written letter to the Email (Internet), or the centralised systems to the decentralised ones (Crypto) — progress always pushes forward.

The reason is that disruptive innovation does precisely that: it disrupts. It ruffles the feathers and creates the volatility the market is currently seeing.

Now that we know what we are investing in, let's look at 4 data-driven reasons as to why this might not be the bear market everyone thinks it is.

Following ‘Smart Money’ to the real crypto trends

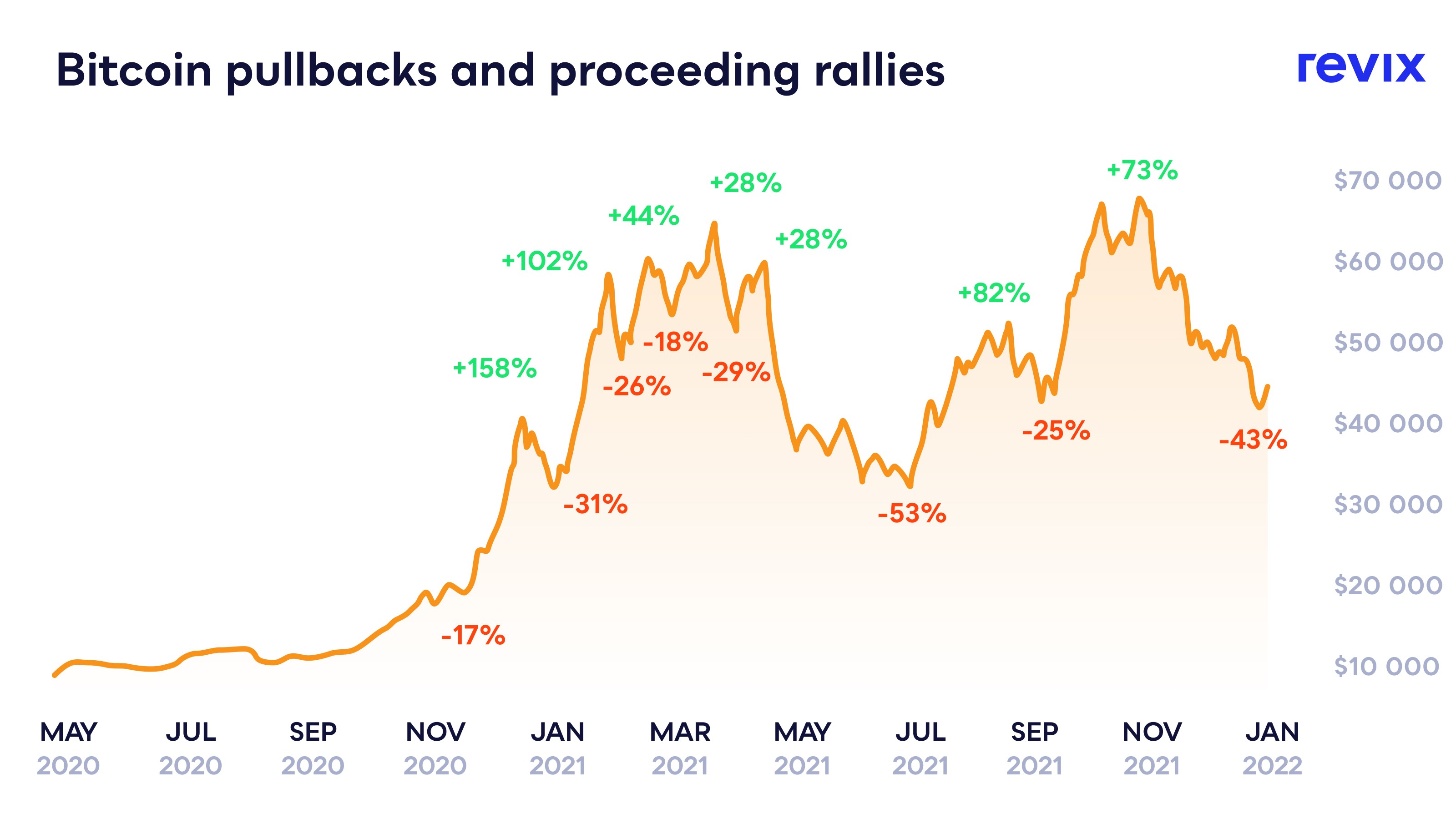

1) We’ve been here before — Historic pullbacks vs rallies

Contrarian investor Baron Rothschild famously said, "The time to buy is when there's blood in the streets."

Essentially he is saying that the best buying opportunities arise when no one wants to buy.

In the case of Bitcoin, we’ve seen these pullbacks all too often. Yet every time people panic and think the end is near, only to be proven wrong again.

During the recent bull market, Bitcoin experienced over 6 pullbacks of greater than -20% and every time it has proceeded to rally more than it pulled back. The recent Bitcoin pullback has been textbook, Bitcoin is now -40% off its all-time highs of $69,000. While many believe that we will likely see a further fall to $32,000 Bitcoin marking the commencement of the “Bear market”, a very similar view to that was taken in July 2021 when Bitcoin was toeing the line of $29,000.

All of this sounding eerily similar?

Will we dip? Will we bounce?

The truth is nobody knows what the market will do. But buying on dips of over -30% has historically played out to be a good long-term decision.

2) “Be fearful when others are greedy. Be greedy when others are fearful."

Another pullback brings another bout of fear… but what if it actually brings opportunity?

Lucky for us, we have a data-driven indicator that tracks market sentiment — it’s called the Fear & Greed Index.

What on earth is that you might ask?

In its basic form, the Fear & Greed index gauges investor sentiment towards the market. The index is made up of multiple market factors such as volatility, momentum, social media and surveys.

As you can see above, the quote holds true to its words. Every time the Fear & Greed index has flashed ‘Extreme Fear’, it might as well have flashed ‘Buy’.

With the Fear & Greed index at its lowest value since July 2021, is this not the same signal?

The last time the index was this low, the market bottomed at around $29,000 Bitcoin and rose over +130% to take the market to new all-time highs.

Some might even notice that the index is currently reading “Extreme Fear”…

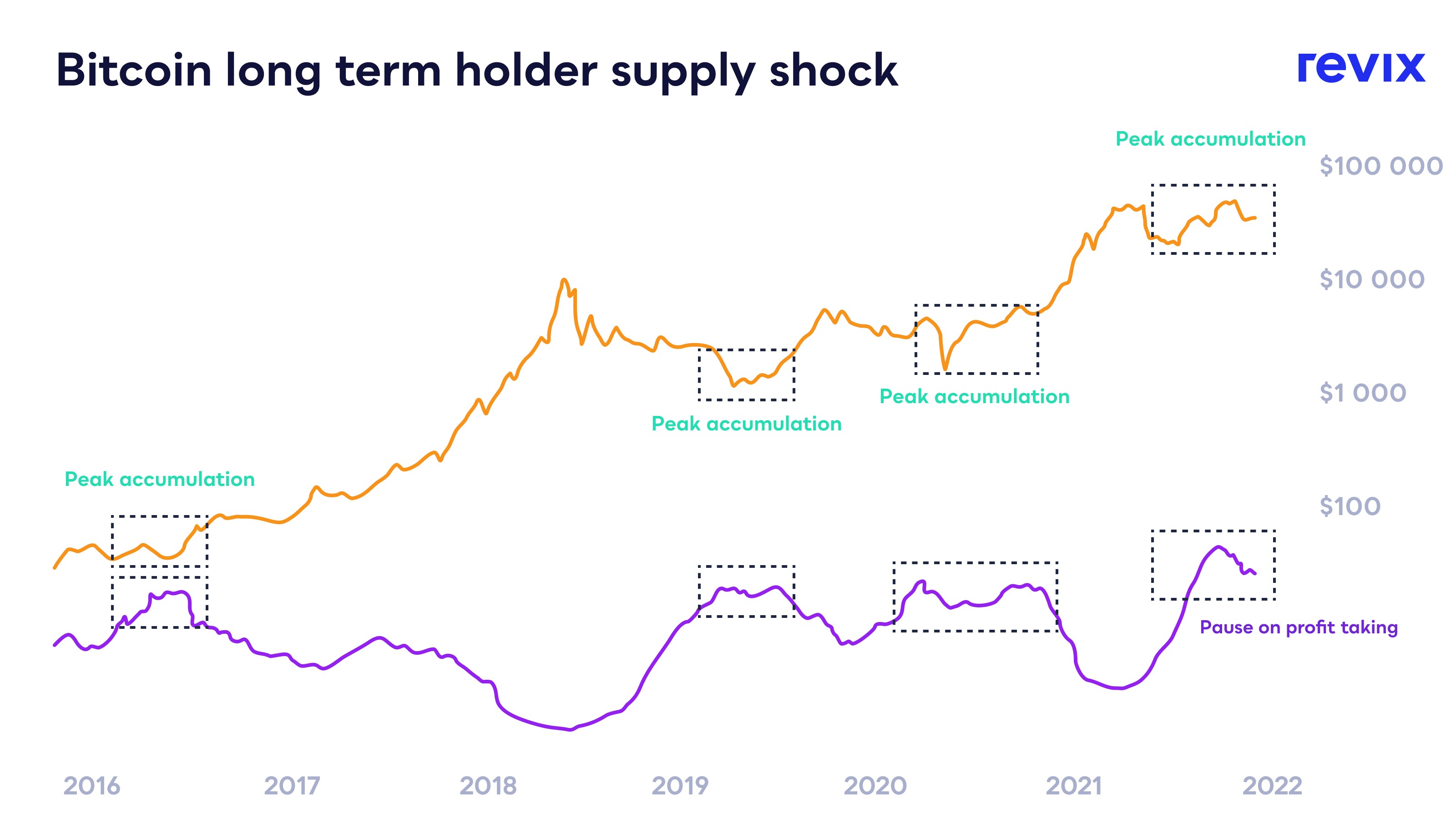

3) Follow the smart money

Remember being told by our elders, “Do as I say and not as I do”?

Well, it turns out this is not the most ideal thing to do when it comes to investing.

Instead of falling into the trap of following “what they say”, you should just look at what smart money investors are doing with their money.

How do I do that? By following what the so-called “smart money” is doing. In crypto, everyone's wallets are visible to the public so you can see what they are putting their focus — and money — into.

As seen above, the long term holders of Bitcoin are in a peak accumulation phase. This means that these investors, (who can be viewed as smart long term investors) are buying this recent pullback and will proceed to sell into the next move up.

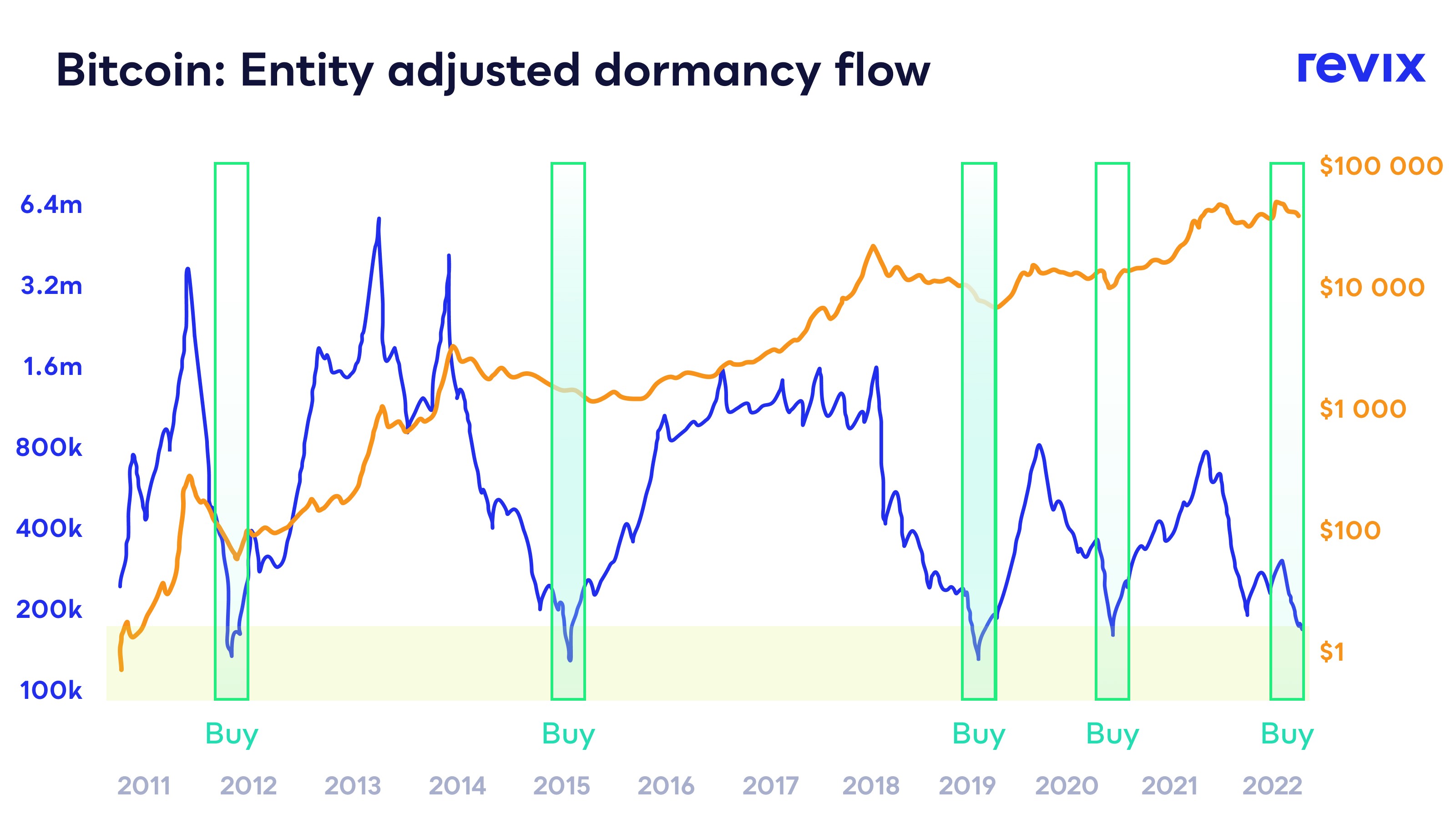

4) Value shopping

Another historically reliable blockchain indicator suggests bitcoin may be in the final stages of a bearish trend, having lost nearly -40% of its value in the past two months.

Entity-adjusted Dormancy Flow compares the Bitcoin market cap (i.e. the value of all Bitcoins in circulation ) to the annualised dollar value of coin dormancy (i.e. how long the coins traded have not been moved i.e Dormant x Current Price).

Without getting too fancy, all this really shows is that the overall value of the Bitcoin market is undervalued relative to the value and age of the coins being sold. This is also coming at a time where, as seen above, long term holders aren’t selling.

Now, you don’t have to be a chartist to see a clear trend here. Historically, whenever the entity-adjusted dormancy flow reaches the green box below, this coincides with a macro bottom in the Bitcoin price. This indicator has called all the preceding bear market bottoms, namely: 2011, 2015, and 2019 market bottom. It has also continued to call the bottom of the COVID-19 crash in March 2020 and is now flashing again.

If history is anything to go by this indicator has been relatively good at noticing when a market is entering its lower levels.

I understand, so maybe investing now isn’t a bad idea. But how do I get exposure?

The 4 data-driven points above put forward some strong arguments that there is potentially still life left in this bull. On a long-term horizon, Bitcoin — and in turn, cryptocurrencies — are just getting started.

Brett Hope Robertson, the Head of Investment at investment platform Revix, commented, “You don’t have to be an experienced investor to beat the traditional markets. Data suggests that you could’ve picked any time in Bitcoins history to invest — be that market tops, bear markets or whenever. As long as you held it for 5 years proceeding the purchase, the minimum you would’ve made is +27% year-on-year for the 5 year period. That means you would’ve outperformed about 99% of fund managers by simply picking the worst possible time to invest. Therefore you have to have a long term investment horizon in this game.”

When you think long term investing in crypto, only one place comes to mind — Revix.

Whether you are looking to invest in the most reputable single assets and take on the risk, or you are looking for a safe option through a basket of diversified cryptocurrencies, we have you covered.

You’ll find an easy to navigate platform for investing in single cryptocurrencies like Bitcoin, Ethereum, Solana, Binance Coin, Polkadot and many more.

But the platform also takes the guesswork out of long term investing by offering you better value for your money with Bundle offerings.

We offer our customers access to ready-made Crypto Bundles that hold the most reputable cryptocurrencies in each sector.

There is no need to pick a single cryptocurrency and run the risk of it not sticking around. With Revix, simply pick the sector you are interested in and we do the rest.

Revix’s empowers users to invest in 3 different theme-based bundles:

The Top 10 Bundle is like the JSE Top 40 or S&P 500 for crypto. It provides equally weighted exposure to the top 10 cryptocurrencies that make up more than 75% of the crypto market. This bundle has significantly outperformed Bitcoin over the last 12 months.

The Smart Contract Bundle provides equally weighted exposure to the top 5 smart contract-focused cryptocurrencies like Ethereum, Solana and Polkadot. These cryptocurrencies enable developers to build applications on top of their blockchains, similar to how Apple builds apps on top of its OS operating system.

The Payment Bundle provides equally weighted exposure to the top 5 payment focused cryptocurrencies looking to make payments cheaper, faster and more global. These cryptos include the likes of Bitcoin, Ripple, Stellar and Litecoin.

Revix Promotion

How would you invest if you knew you couldn't lose? Revix is giving you that chance. From 16th February to 1st March, Revix is offering you the opportunity for an investment that cannot decrease in value. And if it does, Revix has you covered. It's your chance to make money and diversify your portfolio with the confidence that you can only win.

How do I take part?

Sign up using the promo code: COVER. After signing up, you need to invest R5 000 into either the Smart Contract Bundle, the Top 10 Bundle or the Payment Bundle between the 16th February and 1st March 2022*. During this period, your investment is covered against loss. If the value of the Bundle has decreased by the end of the promotion period, Revix will pay you back the difference. It’s that simple. You will be compensated in Bundle units only. *T&Cs apply.

About Revix

Revix brings simplicity, trust and great customer service to investing. Their easy to use online platform enables anyone to securely own the world’s top investments in just a few clicks.

Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

For more information, please visit www.revix.com

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

Brought to you by Revix.

Comments

Post a Comment