PayPal Here POS is a solution for business users who sell in a wide variety of ways. It therefore makes a great solution if you sell online, in marketplaces, in person, offer freelance or consultancy or, perhaps, a combination of all these factors.

PayPal has partnered with POS suppliers, which lets you pair its card reader with point of sale devices for both static outlets and on-the-go mobile setups. Once configured, you’ll be able to process chip, swipe and tap payments, as well as processing Apple Pay and Google Pay transactions making it highly useful during the coronavirus crisis.

Competitor products come from the likes of Sage Pay, PaySimple, Authorize.net, Worldpay, Clover, Helcim and Stripe, all of which are worth a look too.

Save time and money by getting a tailored quote

We work with industry-leading providers to match your requirements with their products. Just tell us what you need from your POS system and our most suitable partners will contact you to see if you want to take things forward.

1. Enter your details below. Simply tell us a bit about what you want from your system, and leave some contact details.

2. We search our database. We’ll match your requirements with the services and prices that our partners offer.

3. Partners will contact you. Only the suppliers who match your requirements will reach out to you.

- Want to try PayPal Here POS? Check out the website here

Pricing

For its mobile card reader fees, that allow you to process POS payments as well as via a smartphone or tablet, the US PayPal currently charges 2.7% per card swipe, while non-US cards are subject to an additional 1.5% cross-border fee and/or 2.5% currency conversion, which is also applied to the transaction. Keyed or scanned transactions are charged at 3.5% + $0.15 per transaction.

In addition, PayPal Here POS systems cover all bases when it comes to processing payments, and it therefore has a full structure of payment charges associated to each type of transaction.

There are no startup costs either, with no monthly fees or a termination cost. If you’re selling goods or services and the sale occurs through an online transaction then for inside the US the fee payable is 2.9% of the transaction amount plus a fixed fee based on the currency if the funds you are receiving come from a PayPal account.

For funds coming from outside the US then the costs is 4.4% of the transaction amount, plus a fixed fee based on the currency. You can find fixed fee charges in relation to specific countries outlined on the PayPal website. Other more specific charges relating to additional costs are covered there too.

If you have a physical store location then money coming from a PayPal account in the US will be charged a fee of 2.7% of the transaction amount or from outside the US a fee of 4.2% of the transaction amount.

Features

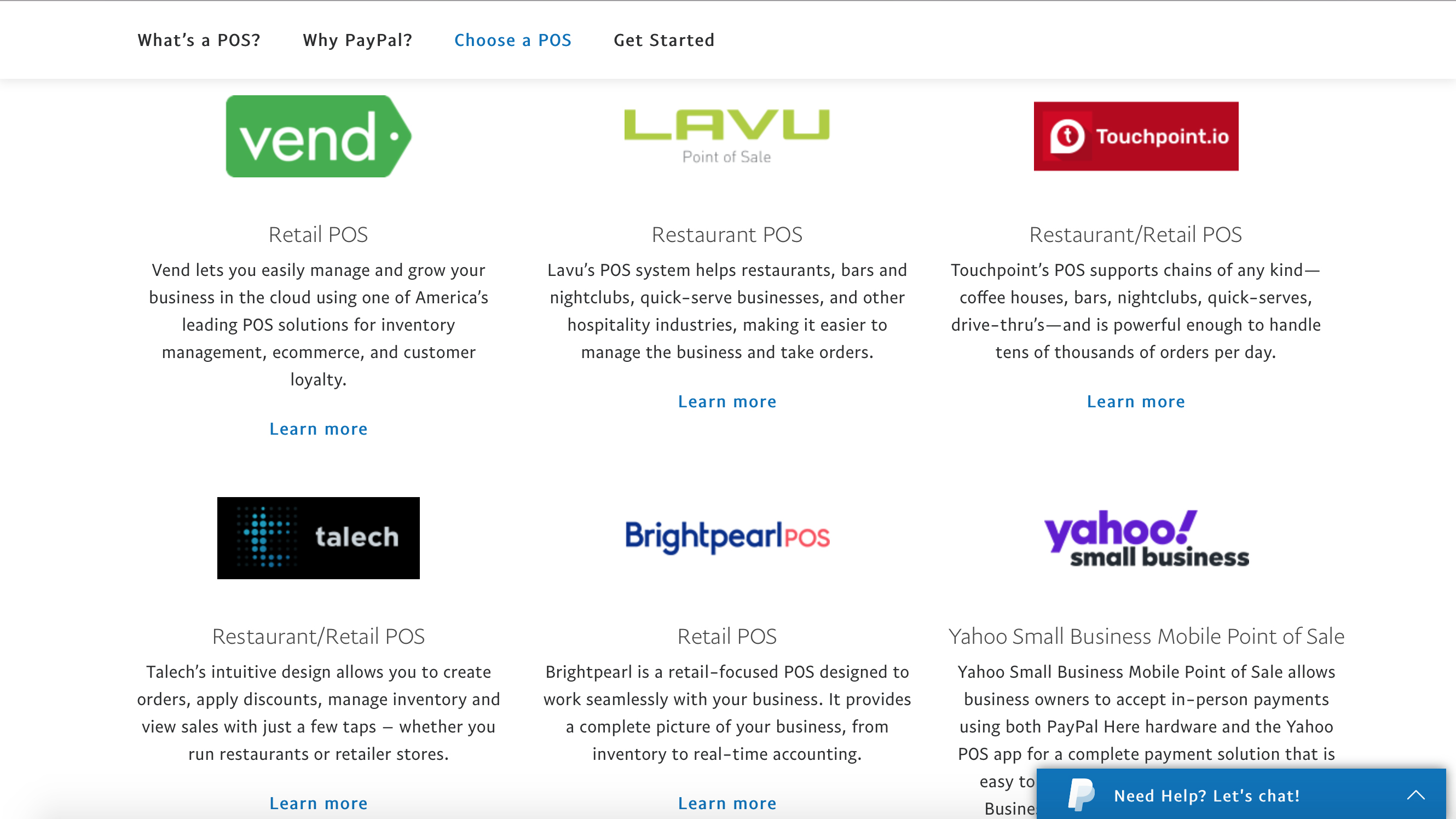

PayPal Here POS has been developed to work with a variety of partners, all of which have integrated it into their systems.

You can choose to select Vend, for retail, Lavu for restaurants, bars and other hospitality industries, Touchpoint, which can work with all sorts of chain businesses, Talech that can be used to function with a variety of restaurant and retail outlets, Brightpearl, which is targeted at the retail sector and Yahoo Small Business Point of Sale.

PayPal Here POS is able to process PayPal payments, plus Venmo, PayPal Credit along with most major credit and debit cards for either its PayPal Checkout or PayPal Payments Standard options.

Your PayPal Here POS options can also be boosted by mating the service with a variety of hardware accessories, including the likes of point of sale stands, cases, receipt printers and cash drawers. These can be used if you have a physical location and, in some cases, for mobile-based businesses too.

Performance

Pulling together the combined aspects of PayPal should mean that you enjoy dependable performance from your POS setup. PayPal processing already has a proven track record and, having partnered with the likes of Vend and Talech, should mean you get a robust back-end to work with too.

Once you’ve gone through the initial steps of linking your PayPal account with your POS it should all be relatively plain-sailing, with the added benefit of additional hardware from PayPal meaning that integrated tech such as receipt printers and cash drawers should work as expected.

Ease of use

Getting hooked up with a PayPal Here POS system is straightforward enough while using it is suitably fuss-free. The POS works in tandem with the PayPal Chip card reader, which allows customers to swipe, insert or tap their card to complete the payment.

The bonus is that PayPal has partnered with that selection of POS suppliers who help to smooth the transaction process. PayPal Here POS has also added a selection of complimentary accessories and all-in-one hardware solutions for making the process of completing transactions much simpler.

To get started you’ll need to sign up for a POS account by calling one of the POS partners, or visiting their website and then sign up for a PayPal account if you don’t already have one. Finally, you’ll need to link the POS account with your PayPal account.

Support

A solid POS system requires a decent level of support, just in case anything does go wrong along the way. PayPal Here POS therefore has live customer support teams available to help you should there be any problems or issues.

This is combined with a heady blend of community support, where you can post questions and hopefully get answers to your queries, a resolution center, which can help solve transactions and more besides. Plus there's a message center too. The latter is a convenient way of sending a text-style enquiry to the support team, which might be a useful way of avoiding the phone if it's not required.

Final verdict

If you’re on the lookout for a quick and simple yet sophisticated point of sale system to invest in then PayPal Here is a worthy contender. It's got everything you need to match it to your business, be it retail, hospitality or service-based. Add in decent transaction rates, solid support levels plus a range of hardware and associated accessories and you’ve got a prime candidate for your next POS system.

If you happen to be a PayPal customer already and enjoy the convenience that brings then you may well already be considering it, though there do seem to be quite a lot of negative reviews from existing customers out there. Higher volume businesses will probably want to look elsewhere too, but PayPal Here POS is fine for those ventures in the small to medium-sized arena.

- We've also highlighted the best POS systems

via Tech Trade

Comments

Post a Comment